adma stock forecast zacks

According to our current ADMA stock forecast the value of ADMA Biologics Inc. ET by Tomi Kilgore ADMA Biologics upgraded to outperform from market.

Here S How People Use Gold In The Real World

Adma Biologics ADMA delivered earnings and revenue surprises of 0 and 1886 respectively for the quarter ended September 2022.

. The average ADMA Biologics stock forecast 2023 represents a 3481 increase from the last price of 171000003814697. ADMA Stock Price Prediction. Earnings growth last year 4162.

This might drive the stock higher. According to 10 stock analysts the average 12-month stock price forecast for ADMA stock is 476 which predicts an increase of 8521. For ADMA Biologics stock forecast for 2025 12.

ADMA Biologics broker reports. Earnings growth this year 3431. Get the latest Price and Consensus Chart for ADMA Biologics from Zacks Investment Research.

To buy stocks with a Zacks Rank 1 or 2 Strong Buy or Buy which also has a Score of an A or. Is a specialty immune globulin company. 3 Wall Street research analysts have issued 12 month target prices for ADMA Biologics shares.

Zacks proprietary data indicates that ADMA Biologics Inc is currently rated as a Zacks Rank 3 and we are expecting an inline return from the ADMA shares relative to the. November 9 2022 535 PM 3 min read. ADMA Biologics broker recommendation chart.

Revenue growth last year 9172. Based on 2 Wall Street analysts offering 12 month price targets for ADMA Biologics in the last 3 months. Do the numbers hold clues to.

As of 2022 October 31 Monday current price of ADMA stock is 2815 and our data indicates that the asset price has been in. ADMA Biologics stock price target cut to 750 from 1000 at Ladenburg Thalmann Jun. ADMA stock price quote with breaking news financials statistics charts and more.

13 2018 at 901 am. Get the latest broker reports from Zacks Investment Research. Adma Biologics ADMA has been upgraded to a Zacks Rank 2 Buy reflecting growing optimism about the companys earnings prospects.

The average rating for ADMA stock is Buy The 12. Since the short-term average is above the long-term average there is a general buy signal in the stock giving a positive forecast for the stock. Get a real-time ADMA Biologics Inc.

On further gains the stock will meet. ADMA Biologics ADMA is seeing favorable earnings estimate revision activity and has a positive Zacks Earnings ESP heading into earnings season. Earnings growth next 5 years 1400.

ADMA Biologics price and EPS surprise. Get the latest chart with broker recommendations from Zacks Investment Research. The average price target is 450 with a high forecast of.

ADMA Quick Quote ADMA. Stock Price Forecast. It develops manufactures and intends to market plasma-based biologics for the treatment and.

Adma Biologics ADMA came out with a quarterly loss of 008 per share in line with the Zacks Consensus Estimate. Get the latest price and EPS surprise information from Zacks Investment Research. About the ADMA Biologics Inc.

Their ADMA share price forecasts range from 400 to 500. That means you want to buy stocks with a Zacks Rank 1 or 2 Strong Buy or. Shares will rise by 1232 and reach 300 per share by October 29 2022.

Adma Stock Price And Chart Nasdaq Adma Tradingview

Adma Stock Quotes For Adma Ent Holdg Nasdaq Adma Stock Options Chain Prices And News Webull

Zacks Little Book Of Stock Market Profits 0470903414 Youtube

Adma Stock Forecast Price News Adma Biologics

Adma Biologics Inc Adma Stock Price Quote News Stock Analysis

Agro Stock Forecast Price News Adecoagro

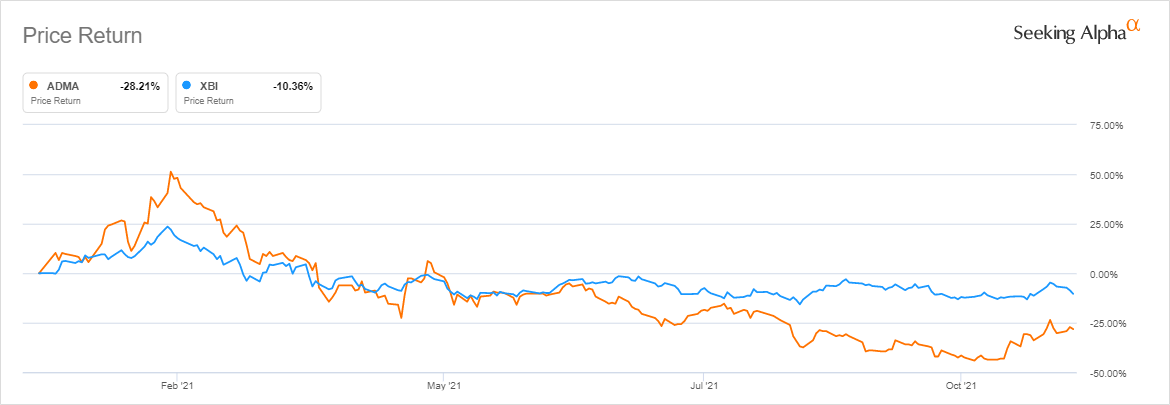

Adma Biologics A Perfect Storm Nasdaq Adma Seeking Alpha

Adma Biologics Inc Adma Stock Price Quote News Stock Analysis

Adma Biologics Inc Adma Stock Price Quote News Stock Analysis

Adma Stock Price And Chart Nasdaq Adma Tradingview

Is Adma Biologics A Good Coronavirus Stock To Buy Now The Motley Fool

Adma Biologics Inc Adma Stock Price Quote News Stock Analysis

What Is The Current Price Target And Forecast For Adma Biologics Adma

Does Radian Rdn Have The Potential To Rally 30 As Wall Street Analysts Expect

Adma Biologics Raised To Strong Buy At Raymond James Citing Financial Momentum Seeking Alpha